First Home Savings Account for Canadians! Mix of TFSA and RRSP!

- Ruthy Siemens

- Apr 1, 2023

- 3 min read

Guess what?

Buying a house can be expensive in Canada!

*Insert Sarcasm here*

According to the Canadian Real Estate Association, Canada’s average home price was $626,318 as of December 2022.

Also, the Bank of Canada aggressively hiked its Overnight Lending rate eight times between March 2022 and January 2023 in order to lower inflation.

Of course everyone knows that buying a home is expensive, so how is the federal government planning to help alleviate some of the pressure for First Time Home Buyers?

Introducing the First Home Savings Account starting in April 2023!

What is a First Home Savings Account (FHSA)?

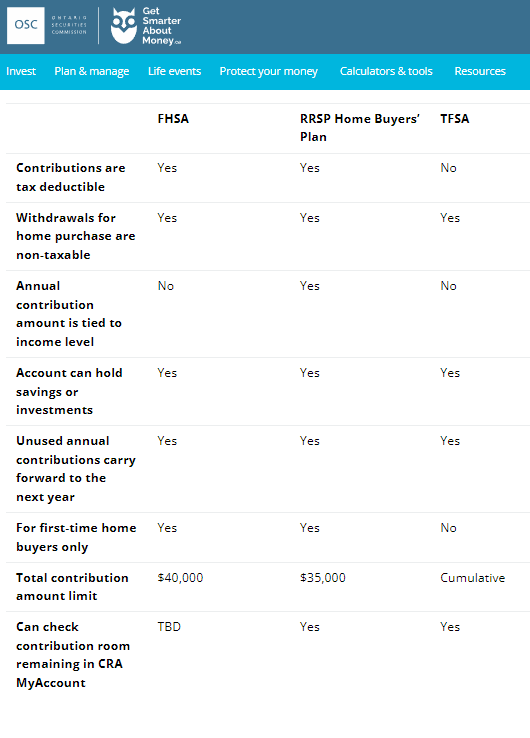

An FHSA combines the features of a Registered Retirement Savings Plan (RRSP) and a Tax-Free Savings Account (TFSA) .

Like an RRSP, contributions are tax-deductible and

Like a TFSA, qualifying withdrawals to purchase a first home would be non-taxable.

Notice that you don't have to be a Canadian citizen!

Thankfully the Get Smarter About Money website, made up a nice table to help us understand the differences between the RRSP Home Buyers Plan and the FHSA and a TFSA.

Unlike the Home Buyers’ Plan, with an FHSA the funds do not need to be paid back.

What If...

If none of these options appeal to you or you feel like you still can't afford to buy a house in Canada, you are not alone. There are many younger Canadians, still unable to buy a home and have instead decided to go a different, less traditional route and have decided to have a lower cost rental home to live in and decide to invest the money into the stock market instead of a into buying a home.

Over the last 2 years, the number of Canadians buying homes has dropped.

In 2020, 17% of Canadians anticipated becoming first-time home buyers within five years whereas in 2022, only 10% of Canadians expected to transition from renter to buyer in the next five years. There is even a "Generation Rent" who seem resigned to rent forever.

However,

“It’s important to help first-time home buyers, as they are the engine of the housing market,”

(https://www.finder.com/ca/generation-rent)

According to CMHC data, 53% of new mortgages in 2021 were from first-time home buyer transactions.

Since First Time homebuyers are so important to the market, what other options are there?

Can I contribute to my spouse’s or adult child’s FHSA?

Can I transfer amounts from my RRSP to an FHSA?

The best choice depends on different factors, such as timing and the potential amount that will be saved. The withdrawals under both plans can be made tax-free, but since you will have to repay the HBP withdrawal, it appears to make sense to contribute to an FHSA first.

When does this start?

As of me posting this blog, the FHSA has not officially started yet but it is good to know that it is expected to begin in April 2023.

What could that mean for you?

Start saving now so that you can take advantage of this new home savings account.

How do you start saving?

By making it a line in your budget!

By making it a SMART goal with a set amount that you want to save and a specific date that you want to save by!

For more info on budgeting check out, 5 Ways you Might be Sabotaging Your Budget.

For Additional Info for First Time Homebuyers, check out my other blogposts.

Now Go and Be Intentional in your Home Buying journey!

Comentarios